Bitcoin Faces Uncertain Future Amidst Potential Market Fluctuations

- Experts warn of Bitcoin’s uncertain future, suggesting market shifts.

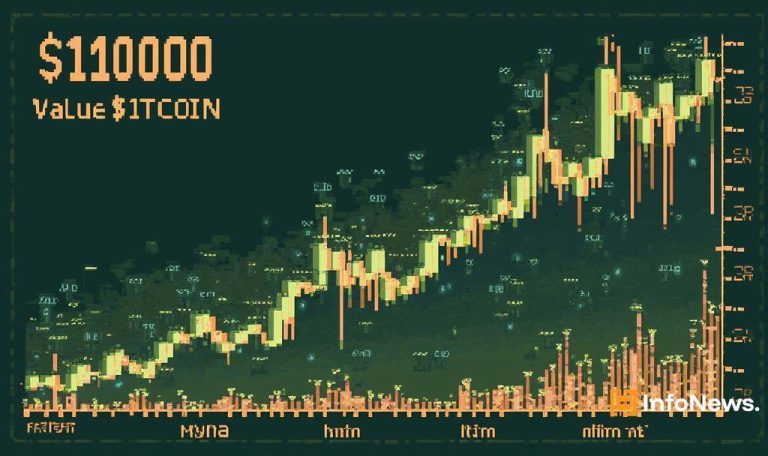

- Bitcoin’s price could significantly drop or reach new all-time highs.

- Community anticipates potential impact on overall cryptocurrency markets.

Bitcoin’s price volatility has led experts to caution that the cryptocurrency may either experience a substantial decline or achieve a new all-time high during Q2 2025. Analysts remain divided over Bitcoin’s potential trajectory.

The ongoing price fluctuations underscore Bitcoin’s unpredictable market behavior. Observers are closely watching for signs of stabilization or further instability, impacting the broader cryptocurrency landscape.

Bitcoin Price Movements Alert Investors

Bitcoin’s recent volatility has highlighted market uncertainties, with prices experiencing frequent shifts. Institutional investors and retail traders are navigating these dynamics amidst a backdrop of regulatory discussions.

Several analysts have predicted divergent outcomes for Bitcoin’s price. While some forecast a potential price rally, others foresee a possible dip. The cryptocurrency’s status as a store of value remains debated.

Bitcoin has exceeded the upper boundary of its 15-month trading channel. My initial forecast for Bitcoin at the peak of this cycle was $120,000, but I’ve now revised it upward to $200,000 by September 2025.

— Peter Brandt, Trader,

Mixed Investor Reactions to Volatile Performance

The ongoing volatility has led to mixed reactions from the investor community. Some express optimism about potential price gains, while others remain cautious about further losses.

According to CoinMarketCap, Bitcoin trades at $87,563.77, with a market cap of $1.73 trillion, holding dominance at 60.60%. The 24-hour trading volume stands at $34.34 billion, up by 178.76%, reflecting rising interest. Over the past 30 days, the price has decreased by 9.45%, highlighting ongoing volatility.

Historical Trends Indicate Possible Recovery

Historically, Bitcoin’s price has undergone similar periods of volatility, often followed by sharp rebounds. Past trends suggest possible recovery; however, market responses remain varied.

Based on historical data, potential outcomes range from significant gains to further losses. Analysts emphasize the importance of market conditions and sentiment in shaping these trends.