Bitcoin’s Rebound: Global Liquidity Sparks New Growth Phase

- Bitcoin’s price surge, driven by liquidity conditions, suggests potential growth.

- Global liquidity trends influence Bitcoin’s upward movement.

- Institutional participation fuels Bitcoin’s resumed bullish trajectory.

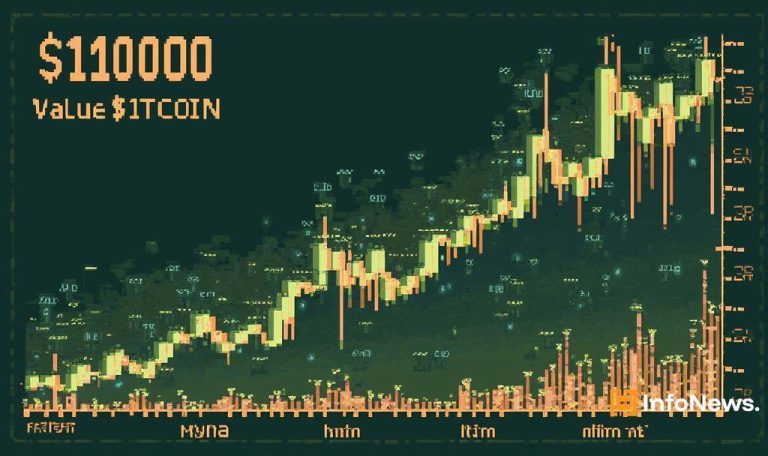

Bitcoin’s price increased from $75,000 to over $90,000 in April amid a rebound in global liquidity, influencing its potential future expansion.

The event underscores the critical role of global liquidity in Bitcoin’s price trends, with market participants showing heightened interest and optimism.

84% Correlation Between Bitcoin and Global M2 Money Supply

Recent analytics indicate that Bitcoin’s price movements closely follow global liquidity trends, with an 84% correlation to the global M2 money supply. Analysts spotlight macroeconomic factors as significant price influences. “Matt Crosby,” Lead Analyst at Bitcoin Magazine Pro, stated, “As liquidity increases across the global economy, Bitcoin price typically responds with upward movement, although with a noticeable delay.”

Key figures including Matt Crosby and Robert Kiyosaki have noted potential upward trends. Bitcoin rebound observed aligns with increased institutional activity, reflecting changing market dynamics.

Institutional Investors Drive Altcoins with Bitcoin Surge

The rising Bitcoin prices have impacted altcoins positively, with tokens such as SUI and Dogecoin showing gains. Institutional investors, including pension funds, are major drivers, pushing optimistic forecasts.

Market participants see Bitcoin’s price surge as an indicator of broad market momentum. Liquidity expansions across major economies drive higher risk appetites, benefiting crypto and traditional assets alike.

Current Liquidity Patterns Echo Bull Markets Post-2020

Historically, liquidity-driven rallies, like post-2020 events, have resulted in sharp asset price increases. Current patterns resemble past exponential growth phases after bear markets, setting the stage for future bull cycles.

Experts suggest that if liquidity trends persist, Bitcoin could enter an extended expansion phase, bolstered by ETF inflows and supportive economic policies. Market dynamics echo previous bullish cycles. Robert Kiyosaki, Investor and Author, remarked, “Strongly believe Bitcoin will reach $180k to $200k in 2025.”

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |