Bybit Hack: $1.4B Stolen, 77% Still Trackable On-Chain

Bybit hack funds laundering raises concerns over DeFi’s role in financial crime, as 77% of stolen assets remain traceable despite large-scale fund conversions.

| Key Takeaways: – Bybit hack funds remain largely traceable, with 77% of stolen ETH still trackable on-chain despite laundering attempts. – THORChain processed 72% of illicit transactions, fueling debates over DeFi’s role in preventing financial crime. – Hackers converted $1 billion to BTC, distributing funds across nearly 7,000 wallets to evade tracking. – The incident triggers scrutiny on DeFi governance, questioning whether decentralized protocols should intervene in illicit transactions. |

On-chain data reveals that hackers laundered 499,000 ETH ($1.4 billion) stolen from Bybit, marking one of the largest crypto thefts in history. The laundering process spanned 10 days, beginning on February 21. Despite these efforts, 77% of the stolen funds remain traceable, while 20% (79,655 ETH) have gone dark, and 3% have been frozen.

In a strategic move, hackers converted 83% of the stolen ETH (417,348 ETH) into Bitcoin, distributing it across 6,954 wallets. This conversion suggests a calculated attempt to obscure asset trails before liquidation via exchanges, OTC markets, or P2P trading.

The Bybit hack funds were primarily laundered through THORChain, a cross-chain decentralized swapping protocol. Analysis indicates:

- 361,255 ETH (~72%) was swapped via THORChain without intervention.

- 79,655 ETH (~16%) was funneled through ExCH, a platform refusing to cooperate with tracking efforts.

- 40,233 ETH (~8%) was moved via OKX Web3 Wallet, requiring further investigation.

THORChain, which earned $5.5 million in fees while facilitating $5.9 billion in swaps, faces backlash for enabling illicit transactions. Critics argue that decentralized platforms must implement safeguards against money laundering. However, THORChain developers maintain that the protocol is fully decentralized and lacks mechanisms to blacklist addresses, reigniting debates on DeFi governance and responsibility.

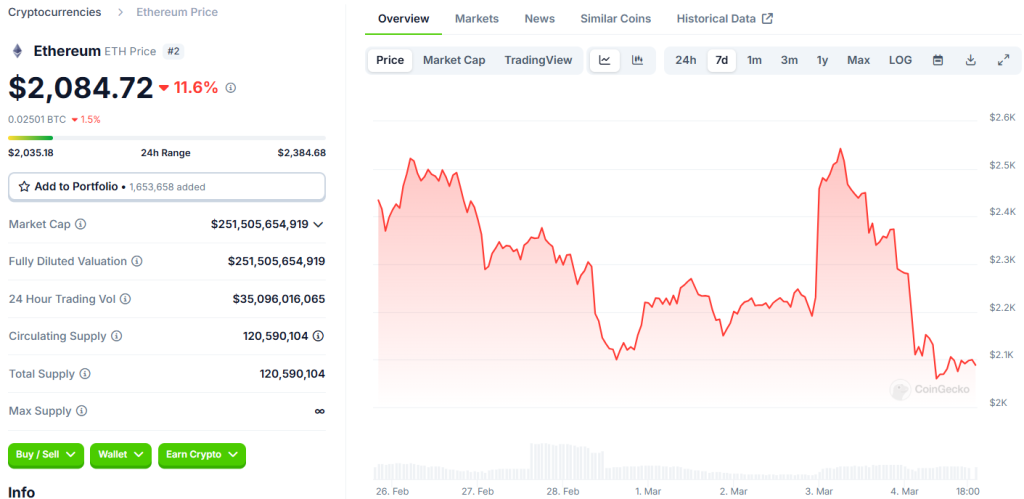

The mass liquidation of Bybit hack funds coincided with Ethereum’s sharp price drop—falling 13% from $2,526 to $2,030 during the laundering period. While exchanges and regulators intensify efforts to freeze illicit assets, the coming weeks will be crucial in determining whether further liquidation can be prevented.

This incident exposes a critical dilemma in DeFi: Should decentralized platforms actively combat financial crime, or would intervention undermine the very principles of permissionless finance? As scrutiny on DeFi governance intensifies, the industry faces growing pressure to balance decentralization with security measures to mitigate illicit activities.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |