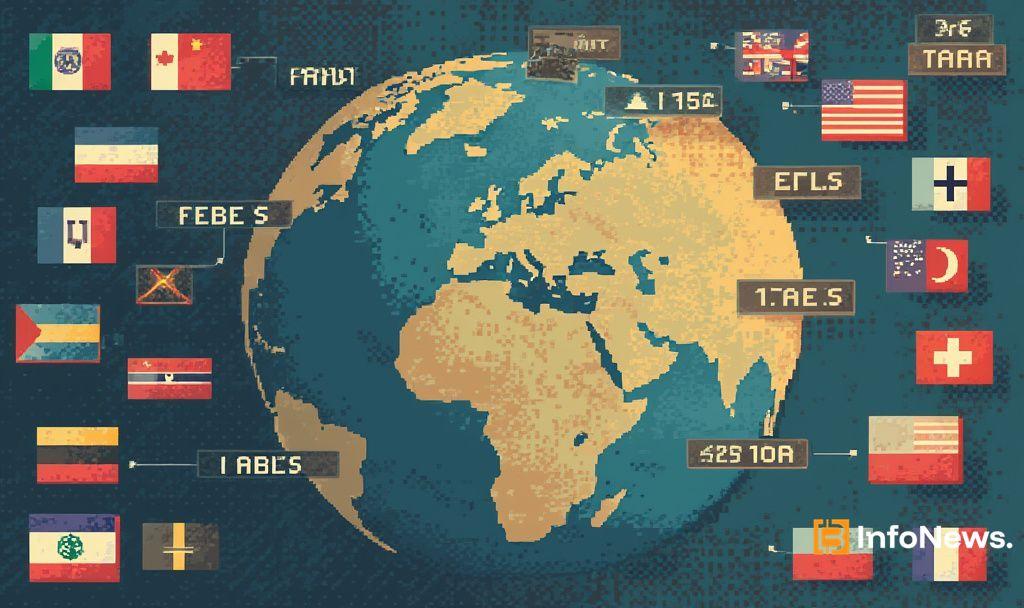

Global Shift: Latest Data Indicates Decline in Dollar Dominance

- Global decline in USD usage highlights economic and market shifts.

- USD usage is decreasing, impacting global commerce.

- Economic and financial stability faces shifts internationally.

New evidence indicates a global decline in the use of the U.S. dollar as nations adjust their economic strategies, raising questions about future financial stability.

This shift in currency dynamics could affect international trade and financial markets, with potential long-term economic impacts under careful scrutiny.

Global Commerce Sees Decline in USD Usage

This change involves major economic players, including governments and financial institutions, opting for diverse currency portfolios. Changing economic policies are driving these moves.

Shifts in Trade Agreements and Exchange Rates

Financial experts predict implications on economic stability and international trust. The move suggests a reevaluation of political and economic alliances.

Currency Shifts Historically Impact Markets

“Broader de-dollarization efforts by China, or other major economies, will threaten the status of the dollar’s global reserve currency status. This could have profound impact on the US and its economy, as this would lead to nations reducing their holdings of US treasuries, which the US relies on to finance its national debt.” — Zhong Yang Chan, Head of Research, CoinGecko

Experts analyzing trends point to possible economic realignments based on historical financial data. The outcomes could redefine global economic structures.