Henry McPhie Leads $1.1B Streamex Pivot From BioTech to Regulated Tokenized Gold

Key Points:

- Henry McPhie and team led a $1.1B raise to fund gold tokenization.

- Streamex leadership includes Frank Giustra and Sean Roosen from top mining firms.

- The team built SEC-compliant infrastructure for real gold-backed digital assets.

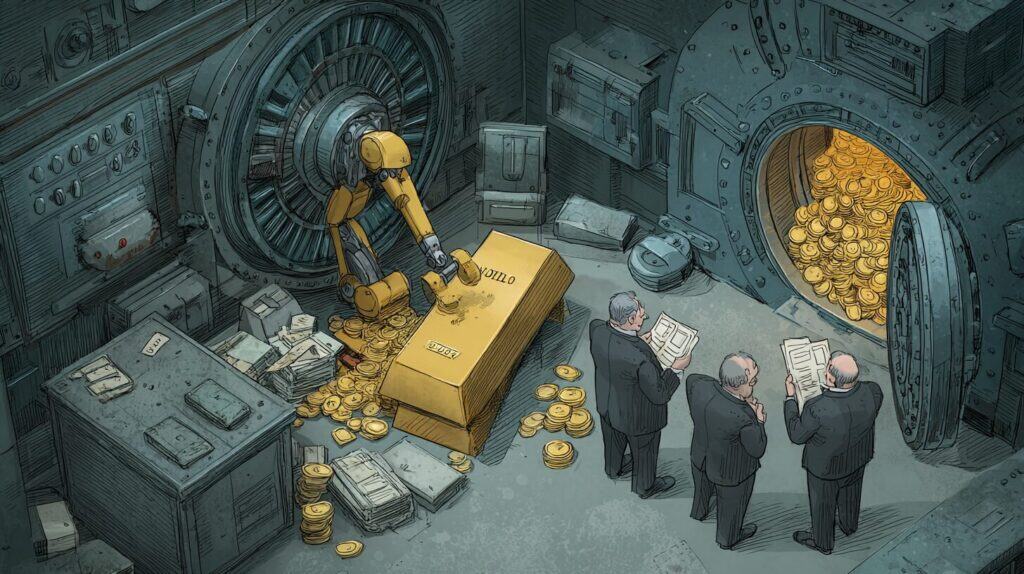

Streamex CEO and Co-Founder Henry McPhie led a strategic shift for BioSig Technologies (NASDAQ: BSGM), from its biotech origins to blockchain tokenization of real commodities. The transition positions Streamex one of the first listed platforms focused on gold-backed digital assets, supported by a July 2025 announced $1.1 billion funding.

The pivot represents a broader move towards institution-sized tokenized assets, with Streamex building infrastructure that integrates physical bullion, blockchain automation, and access to public capital markets.

McPhie Leads $1.1B Raise as BioSig-Streamex Merger Finalizes

Having first been educated in mining engineering and serving in the biotech industry, McPhie entered the digital asset industry in 2023.

His leadership has been responsible for establishing BioSig as a tokenized commodities issuer. In May of 2025, Streamex and BioSig entered into a letter of intent to merge, with the transaction completed before the announcement of funding.

By July 2025, the recently combined company raised as much as $1.1 billion of capital, including:

- $100 million 4% coupon convertible debentures

- $1 billion equity line of credit to be drawn over a 36-month period

The funds will be utilized to fund a blockchain-based issuance and liquidity strategy with an initial concentration on tokenized gold.

Unlike Paxos, Streamex Seeds Gold Markets With Own Treasury

Streamex’s business model is centered on balance-sheet-backed issuance. In contrast to issuers such as Paxos (PAXG) or Tether (XAUT), who tokenize gold held in third-party vaults and issue offsetting tokens, Streamex will:

- Hold physical gold through a high-quality bullion custodian

- Deposit a fraction of its treasury directly into gold reserves

- Use that capital to seed new on-chain markets’ liquidity

Revenue streams include origination fees, tokenization fees, and market-making revenues. The first product, a regulated, tokenized gold product, is set to be launched in early 2026, with SEC-registered trading infrastructure already underway.

Giustra, Roosen Join Streamex to Lead Regulated Gold Tokenization

McPhie assembled an executive and advisory team with high degrees of experience in mining, capital markets, and blockchain innovation:

- Frank Giustra, a serial entrepreneur and founder of multiple mining projects with combined market caps of more than $50 billion

- Sean Roosen, Osoco Mining founder, previously North America’s largest gold producer

- Mitchell Williams, Chief Investment Officer with structured digital asset experience portfolio

Streamex is already in regulation in Canada and working its way towards U.S. broker-dealer registration. Its ultimate objective is to offer tokenized commodities and yield-based structured products under NASDAQ regulation via the listing on BSGM.

With NASDAQ Access and Full Stack, Streamex Sets Tokenization Pace

| Milestone | Date |

| Merger LOI Signed | May 5, 2025 |

| $1.1 Billion Financing Secured | July 8, 2025 |

| McPhie Public Interview Tour | Mid-July 2025 |

| Tokenized Gold Launch Target | Q1 2026 (Projected) |

The merger and financing have placed Streamex among a small number of digital asset companies with both public-market access and end-to-end issuance infrastructure.

Streamex Targets $142T Market With Regulated Gold Token Launch

At the time of a July 2025, AInvest reports, Streamex will be providing institutional and sovereign clients seeking digital ownership of hard assets as inflation fears, fiat devaluation, and policy shifts by central banks intensify.

The company is entering a global commodities universe of about $142 trillion in size and has special interest in tokenizing precious metals and other asset classes down the road.

Its infrastructure model blends:

- Smart contract-based issuance and redemption

- DeFi-enabled market access

- Public company oversight through NASDAQ governance

Directed by Henry McPhie, Streamex has transitioned from a biotech firm to a regulated digital asset infrastructure provider. Backed by a $1.1 billion funding strategy and headed by commodity-market professionals, the firm is predicted to launch its first tokenized gold product in 2026. With a focus on public-market openness, blockchain programmability, and physical asset backing, Streamex is shaping itself as a new kind of financial institution linking hard assets and programmable money.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |