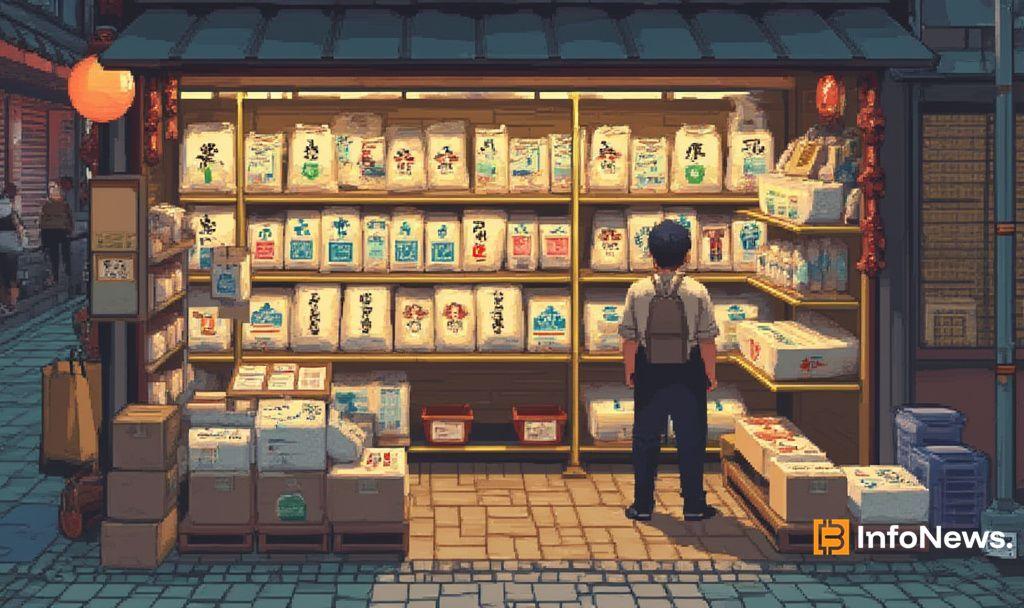

Japan’s Yen Weakness Fuels Rising Rice Crisis

- The yen’s weakness exacerbates Japan’s rice supply issues, affecting smaller businesses.

- Rice prices in Japan have surged by 71% from last year.

- Large conglomerates dominate the market, leaving smaller retailers disadvantaged.

The weakening yen has intensified Japan’s rice crisis, impacting market dynamics and smaller retailers as of October 2023.

This situation highlights the economic strain on smaller businesses and potential policy responses from financial authorities.

Yen Weakness Drives 71% Rise in Rice Prices

Japan’s rice market is under strain as the yen’s weakness impacts import costs. Larger entities secure top-quality grain, sidelining smaller shops. The crisis is compounded by policy constraints and recent climatic disruptions.

The Bank of Japan and agricultural policymakers are central to the crisis as the yen depreciates, increasing import costs. No official statements have yet emerged from key stakeholders.

3.6% Inflation Surge Stresses Japanese Households

The rice price surge impacts Japanese households, with smaller shops struggling for stock. Large corporations dominate, creating supply imbalances and intensifying market competition.

The financial implications include a notable inflation rise exceeding 3.6%, straining budgets. This situation demands attention from policymakers to address stability concerns.

1970s-Style Production Caps Revisited

Japan’s current crisis mirrors the 1970s when production caps impacted rice availability. Regional parallels include climatic shocks in Thailand and the Philippines, leading to heightened imports and policy adjustments. Experts illustrate that Japan’s rice production management since the 1970s has made the country more susceptible to crises like this, drawing parallels to similar global rice supply issues in Thailand and the Philippines.

The yen’s depreciation might prompt calls for monetary intervention to stabilize economic conditions, drawing on the historical tendency for response to currency-driven crises.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |