Crypto Exchange Kraken Preparing for IPO in 2026

Kraken Exchange Plans To Go Public In Q1 2026, Seeking To Be The Second US Cryptocurrency Exchange Listed After Coinbase, Following Improved Regulatory Conditions.

| Key Takeaways: – Kraken exchange is planning to make its public debut as soon as the first quarter of 2026, with the goal of being the second U.S. cryptocurrency exchange to go public after Coinbase. – Earlier intentions to go public were delayed because of SEC enforcement actions during the Biden administration. However, with Donald Trump’s return to influence, there is now an improved regulatory atmosphere. |

Kraken exchange is said to be gearing up for an initial public offering (IPO) as soon as the first quarter of 2026, based on sources cited by Bloomberg.

If successful, the San Francisco-based firm, formally identified as Payward Inc., will be the second U.S. cryptocurrency exchange to go public, following Coinbase, which went public in April 2021.

Kraken exchange has had its sights set on pursuing an initial public offering (IPO) for some time; however, earlier attempts were obstructed by regulatory hurdles during the Biden administration.

The company encountered enforcement actions from the U.S. Securities and Exchange Commission (SEC), which accused that it was functioning as an unregistered securities exchange, broker, dealer, and clearing agency.

In November 2023, the SEC accused Kraken exchange of mixing customer funds with its own. Despite this, Kraken reached a settlement in one of the cases with the SEC and continued to contest another until the agency decided to withdraw it earlier this month.

According to a blog post from the company on March 3, the dismissal did not involve any charges, fines, or mandated adjustments to Kraken’s business practices.

The regulatory environment has changed with Donald Trump’s return to the presidency, resulting in a more supportive atmosphere for cryptocurrency businesses. Kraken’s Co-CEO Arjun Sethi joined various industry leaders at a White House crypto summit held on March 7.

The reduction of regulatory constraints has motivated several other cryptocurrency companies, such as stablecoin provider Circle, digital asset custodian BitGo, and exchanges like Gemini and Bullish, to consider the possibility of going public as well.

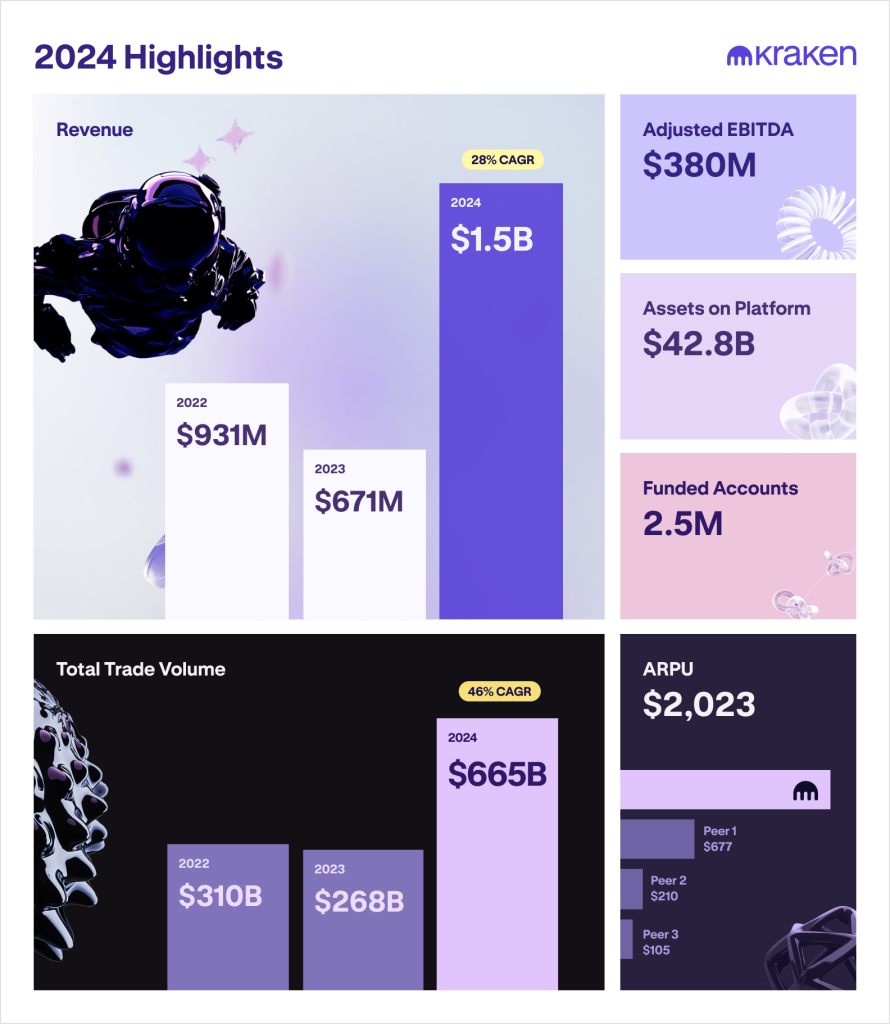

The Kraken exchange saw substantial financial expansion, as its revenue more than doubled in 2024, increasing from $671 million to $1.5 billion.

Sethi highlighted the organization’s dedication to transparency, mentioning that Kraken will keep producing quarterly reports to get ready for a possible IPO.

Although Kraken’s plans for an IPO may evolve, the company’s enhanced regulatory position and strong financial performance indicate that it is preparing for a potential public launch soon.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |