Nemesis Darknet: US Sanctions 49 Crypto Wallets

Nemesis Darknet faces US sanctions, with 49 crypto wallets blacklisted for illicit trades. Monero’s role in darknet transactions raises regulatory concerns.

| Key Takeaways: – Nemesis Darknet marketplace faces US sanctions, with 49 crypto wallets blacklisted for alleged involvement in illicit activities. – Authorities claim Nemesis facilitated $30 million in illegal trades, including narcotics, stolen data, and cybercrime tools. – Monero’s inclusion in the sanctions raises concerns about tracking privacy coins in darknet transactions. |

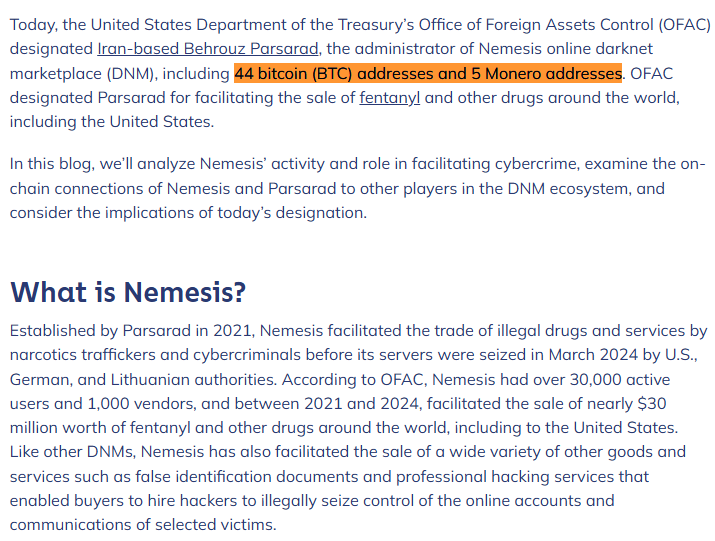

The U.S. Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned Nemesis Darknet, a notorious online marketplace allegedly responsible for facilitating nearly $30 million in illicit transactions. As part of the crackdown, 49 cryptocurrency wallets have been blacklisted, including 44 Bitcoin (BTC) addresses and 5 Monero (XMR) wallets linked to the platform’s operations.

According to Chainalysis, Iranian national Behrouz Parsarad is accused of running the marketplace, profiting millions in transaction fees from the sale of illegal goods and services. The platform reportedly allowed users to purchase narcotics, forged documents, stolen data, and cybercrime tools, including phishing kits and DDoS-for-hire services.

The US government’s decision to target Nemesis Darknet reflects its increasing efforts to combat illicit crypto activity and dismantle financial networks that facilitate cybercrime.

One of the most notable aspects of this enforcement action is the inclusion of Monero (XMR) wallets in the sanctions list. Unlike Bitcoin, which operates on a transparent ledger, Monero’s privacy-focused blockchain makes tracing transactions nearly impossible.

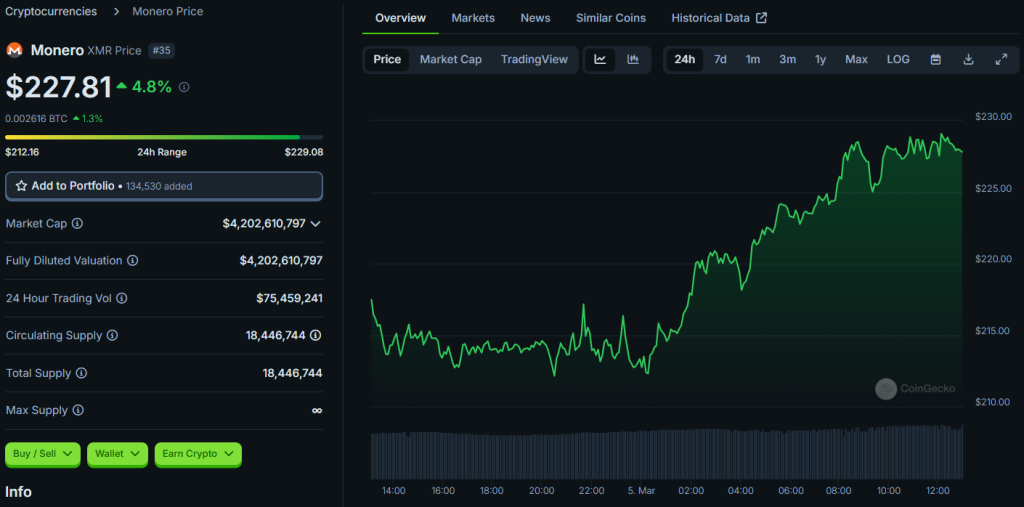

Despite regulatory scrutiny, XMR’s price surged by 4.8% following the sanctions announcement, suggesting continued demand for privacy-enhancing cryptocurrencies. Law enforcement agencies have long expressed concerns over Monero’s role in darknet transactions, as it provides a layer of anonymity that makes it difficult to track illicit financial flows.

With growing pressure on privacy coins and decentralized exchanges, the Nemesis Darknet case could serve as a precedent for future regulatory actions against platforms enabling untraceable transactions.

The Nemesis Darknet sanctions are part of a broader effort by US authorities to crack down on illicit online marketplaces. This follows previous high-profile operations, including:

- 2022 – US and German law enforcement shut down Hydra Market, the world’s largest darknet marketplace at the time, which processed over $1.3 billion in transactions.

- 2025 – Former Silk Road founder Ross Ulbricht received clemency, reigniting debates over darknet markets and law enforcement effectiveness.

Despite multiple takedowns, darknet markets continue to evolve, often rebranding under new names and leveraging decentralized tools to evade law enforcement. Privacy-focused cryptocurrencies like Monero and decentralized finance (DeFi) protocols further complicate regulatory efforts.

While the US crackdown on Nemesis Darknet signals a continued push against illicit financial networks, the effectiveness of such measures remains uncertain. As technology advances, authorities face growing challenges in enforcing regulations without undermining crypto’s core principle of decentralization.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |