New Tokenomics for JTO: Proposed Model for Buybacks & Growth

New Tokenomics for JTO explores buybacks, liquidity incentives, and staking rewards to boost ecosystem growth while balancing sustainable revenue distribution.

| Key Takeaways: – New Tokenomics for JTO introduces buybacks, staking rewards, and reinvestment strategies. – The model balances “value recycling” and “value rewards” to enhance JTO’s utility. – Community debates focus on regulatory risks, market impact, and long-term sustainability. |

A new proposal for new tokenomics for JTO has been introduced, aiming to optimize JTO’s role within the Solana ecosystem. Spearheaded by Jito Foundation contributor Andrew Thurman, the initiative focuses on leveraging Jito’s revenue for long-term growth rather than simply accumulating treasury funds.

The framework introduces two core strategies: “value recycling” (reinvesting earnings into ecosystem expansion) and “value rewards” (redistributing a portion of protocol fees to token holders). By combining both approaches, Jito DAO aims to create a sustainable model that aligns incentives across the ecosystem.

A key component of new tokenomics for JTO is a potential buyback mechanism, a strategy successfully adopted by MakerDAO, Raydium, and Jupiter. This model reduces token supply, potentially increasing JTO’s value while ensuring sufficient liquidity for trading.

Another proposed method is a fee switch, similar to Uniswap’s debated revenue-sharing model, where JTO holders would receive direct rewards from protocol earnings. However, concerns regarding regulatory scrutiny persist, as past implementations of similar models have faced legal uncertainty.

To further refine New Tokenomics for JTO, Thurman suggests two novel approaches:

- Buyback and Barter: Jito DAO could exchange revenue for tokens from partnered projects at discounted rates, strengthening alliances while reducing JTO’s circulating supply. However, risks such as counterparty failures must be considered.

- Real Yield Gauges: Inspired by Curve Finance, this system allows JTO holders to stake in JitoSOL or JTO liquidity pools and vote on reinvestment strategies, reinforcing governance participation.

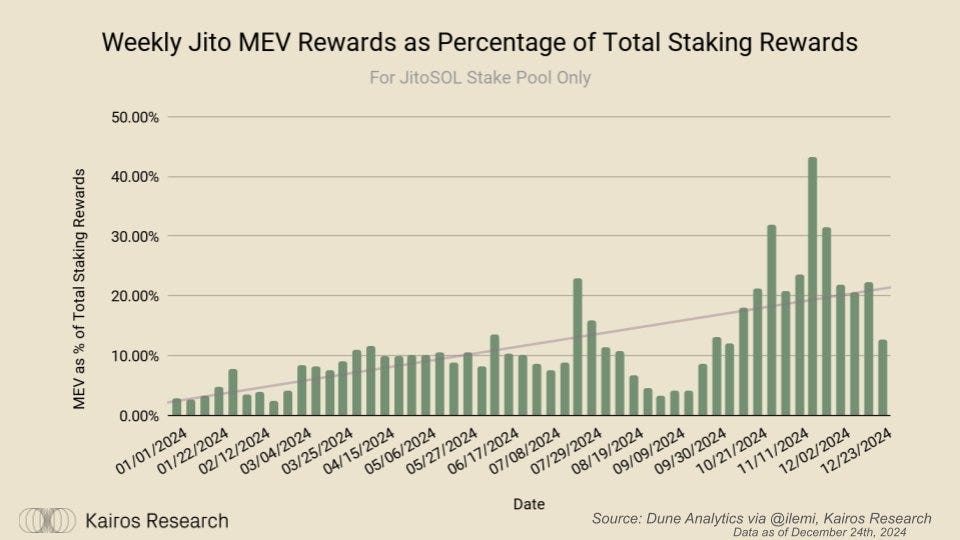

Currently, Jito receives 4% of all JitoSOL staking rewards and 3% of tips routed via TipRouter, according to data from Kairos Research. This revenue stream could be reinvested into liquidity provisions, stabilizing the market while generating sustainable returns.

The New Tokenomics for JTO proposal has sparked debate within the Jito community. Some argue that buybacks should be prioritized during bear markets, while others favor yield-enhancing incentives during growth phases. A hybrid model combining both strategies may offer the most balanced approach.

With JTO’s price currently at $2.6—down 53% from its all-time high of $5.6—competition within Solana’s ecosystem remains intense. The final decision on New Tokenomics for JTO will ultimately rest with Jito DAO governance, shaping the protocol’s future in the evolving DeFi landscape.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |