Robert Kiyosaki Predicts Bitcoin to Hit $1M by 2030

- Kiyosaki predicts Bitcoin reaching $1 million by 2030.

- Author urges accumulation over price tracking.

- Bitcoin remains a hedge against inflation.

Kiyosaki Advocates Bitcoin Ownership, Cites Historical Low Prices

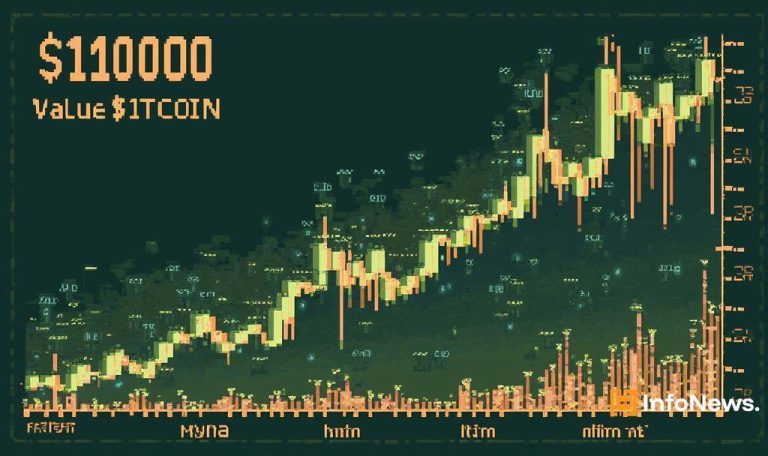

Robert Kiyosaki, known for advocating hard assets, has consistently emphasized accumulating Bitcoin over tracking its price. He made this prediction on social media, aligning with views from other notable figures. Historical investments reportedly began when Bitcoin’s price was around $6,000.

Influential figures like Jack Dorsey support similar forecasts, amplifying Kiyosaki’s message. The stance on Bitcoin as a store of value contrasts with traditional financial assets, which influence market sentiment and investor behavior.

“Poor people focus on price. Rich people on quantity. I do not care much about the spot price of gold or silver. I do care about how many ounces of gold and silver I control. The same with Bitcoin. While I watch the price of Bitcoin I focus on how many Bitcoin I own.” — Robert Kiyosaki

Market Buzz: Bitcoin as a Risk-Off Asset

Kiyosaki’s prediction has influenced market discussions, though no immediate structural shifts in institutional investment have been recorded. Bitcoin’s role as a hedge in volatile economic climates continues to solidify, according to ongoing dialogue.

Financial experts highlight Bitcoin’s emergence as a risk-off asset, attracting attention amid economic uncertainty. Comments like Kiyosaki’s may fuel market optimism, although practical effects remain subject to broader financial trends.

Expert Predictions Fuel Market Sentiment, Spur Retail Interest

In recent years, predictions by well-known figures have resulted in increased engagement and minor retail buying surges. Such forecasts historically correlate with positive market sentiment, albeit without dramatic price movements.

Analysis suggests these predictions cater to long-term investors, expecting gradual market maturity. While minor fluctuations in Bitcoin’s price may occur, the focus remains on its potential as an inflation hedge.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |