Robinhood Q1 Crypto Revenue Surpasses Wall Street Expectations

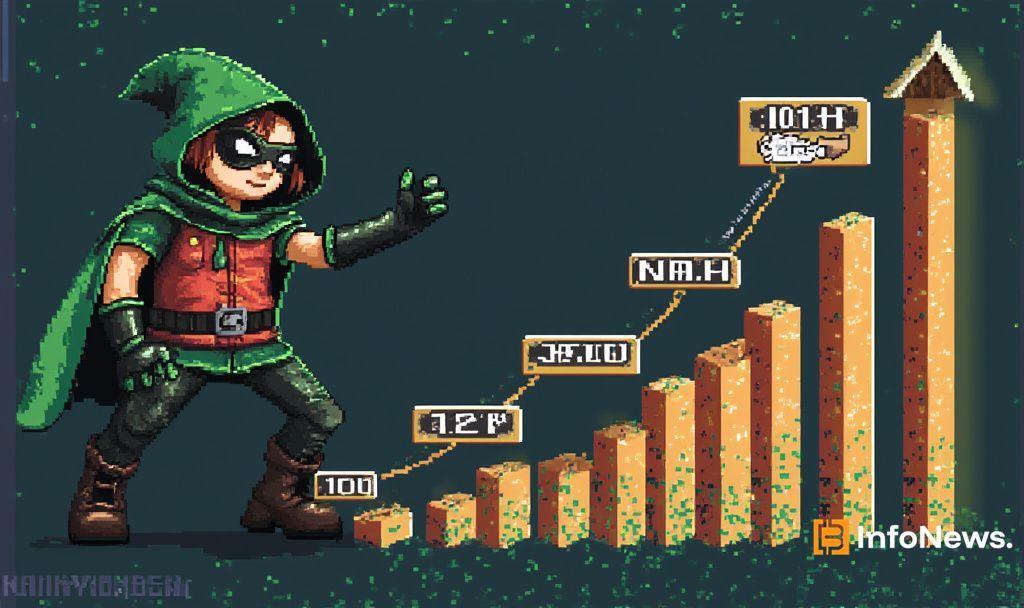

- Robinhood’s Q1 2025 crypto revenue increased by 100% YoY.

- The surge surpassed Wall Street’s expectations.

- Expanded crypto offerings include Bitcoin, Ethereum, and altcoins.

Robinhood announced a 100% increase in crypto revenue year-over-year for Q1 2025, outpacing Wall Street expectations.

This revenue surge could signal a strong retail rebound in cryptocurrency engagement, as Robinhood expands its tradable crypto asset list.

Robinhood Q1 Crypto Revenue Doubles YoY

Retail Interest Spikes in BTC and Altcoins

Q4 2024 Patterns Repeat in Latest Surge

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |