Real-World Asset Tokenization Boosts Market Efficiency

- Tokenized assets increase market efficiency and democratize asset access.

- Financial markets become more transparent and inclusive.

- Integration with DeFi boosts liquidity and trading activity.

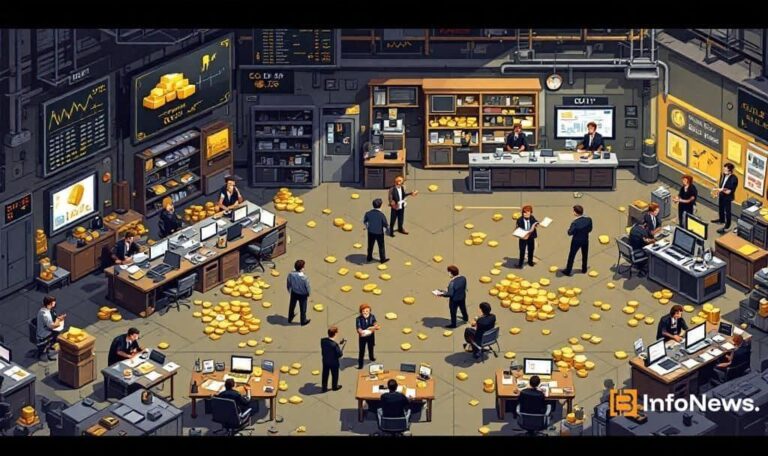

Tokenized Real-World Assets (RWAs) are transforming global financial markets by converting physical assets to digital format on blockchains.

The tokenization of real-world assets significantly enhances transparency in financial markets, offering new investment opportunities and increasing engagement in decentralized finance.

RWAs Gain Momentum with Blockchain Integration

Tokenized Real-World Assets (RWAs) are gaining traction as digital representations of physical assets on blockchains, enhancing market efficiency. This process allows unique assets like real estate and commodities to be converted into tokens.

Major platforms and industry leaders, including the Token Alliance, are advocating for these innovations. Leaders emphasize that tokenization simplifies ownership and democratizes access to previously exclusive assets.

Increased Liquidity Highlights Financial Market Evolution

Financial markets are experiencing significant changes due to increased liquidity and trading volumes. This integration is evident through rising Total Value Locked (TVL) in RWA-specific protocols. Lilya Tessler, Co-chair of the Token Alliance, stated, “Tokenization of real-world assets has the potential to create more efficient, transparent, and inclusive financial markets, facilitating investment and ownership at a global scale.”

Regulators and institutions recognize the need for clear policies to manage these new opportunities. The result is tighter collaboration between blockchain developers and financial agencies to ensure widespread adoption.

Historical Parallels in RWA Tokenization Surge

The shift towards RWA tokenization is similar to early blockchain initiatives that improved transparency. Past efforts with real estate and collectibles saw increased investor engagement and liquidity. Insights on these trends can be further explored here.

Analysis suggests that continued regulatory support will further amplify digital asset adoption. Future developments are likely to focus on robust legal and technical infrastructures to facilitate growth.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |