SEC and CFTC Officials Reaffirm Market Supervision as Crypto Enforcement Shifts

The SEC And CFTC Reaffirm Their Commitment To Crypto Regulation Enforcement Despite A Decline In Cases And A Strategic Shift At The SEC In 2024.

| Key Takeaways: – SEC and CFTC officials emphasized their ongoing dedication to policing market misconduct despite policy shifts under the Trump administration. – The SEC has reduced its crypto enforcement, including withdrawing cases against major firms, while overall enforcement actions declined in 2024. |

As reported by Reuters, federal market regulators have reaffirmed their dedication to enforcing cryptocurrency regulations, even as significant changes occur under the Trump administration.

During an American Bar Association event in Miami, officials from the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission highlighted that, regardless of changes in agency leadership, the crypto enforcement regulations remains a priority.

Antonia Apps, acting deputy enforcement director at the SEC, recognized changes in priorities while emphasizing that fundamental enforcement initiatives will continue.

“You can expect to see some changes based on priorities and the different policies we may pursue,” Apps said. “But we are going to move forward with the core enforcement agenda we have always moved forward with.”

Brian Young, the enforcement director at the CFTC, reaffirmed the agency’s commitment to overseeing the markets. He pointed out a change in enforcement approach, focusing more on cases that have the potential to compensate victims of fraud or market manipulation. Young praised the enforcement team, acknowledging their significant contributions and commitment to safeguarding investors.

There have been significant changes in crypto enforcement, as the SEC has halted or withdrawing several prominent cases, including those involving Coinbase, Robinhood, Gemini, and Uniswap Labs.

Recently, the agency dismissed a lawsuit against Kraken and concluded an investigation into the non-fungible token firm Yuga Labs. Besides, The New York Times reports that the SEC is reportedly downsizing a specialized team of more than 50 attorneys focused on crypto enforcement.

Despite changes in strategy, Apps confirmed the SEC’s ongoing scrunity regarding the cryptocurrency industry. “We are not walking away,” she said, emphasizing that the agency’s intention to take action on cases of fraud and other matters within its jurisdiction.

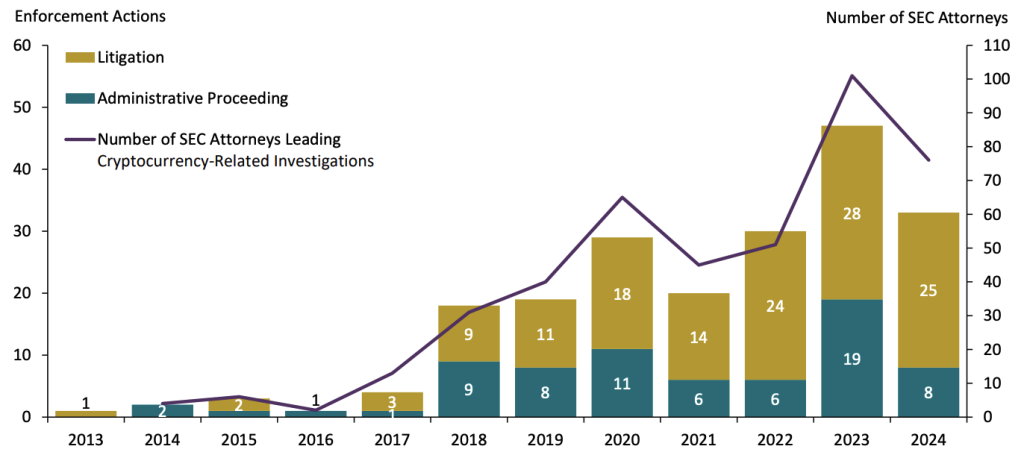

Under former SEC Chair Gary Gensler, the number of enforcement actions related to cryptocurrencies peaked in 2023 but saw a decrease in 2024. A report from Cornerstone Research revealed that the SEC initiated 33 enforcement cases related to cryptocurrency in the previous year, marking a 30% reduction from 2023 and representing the first decline in year-over-year activity since 2021.

The agency launched 25 lawsuits in federal district courts and eight administrative actions in 2024. Although the total number of cases decreased, monetary penalties soared to a record $4.98 billion, driven by a multi-billion-dollar settlement.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |