Standard Chartered Warns of Bitcoin Holding Risks

- Standard Chartered warns of potential Bitcoin liquidation risks.

- Risk if Bitcoin drops 22% below average cost.

- Corporate holdings at high purchase costs pose threat.

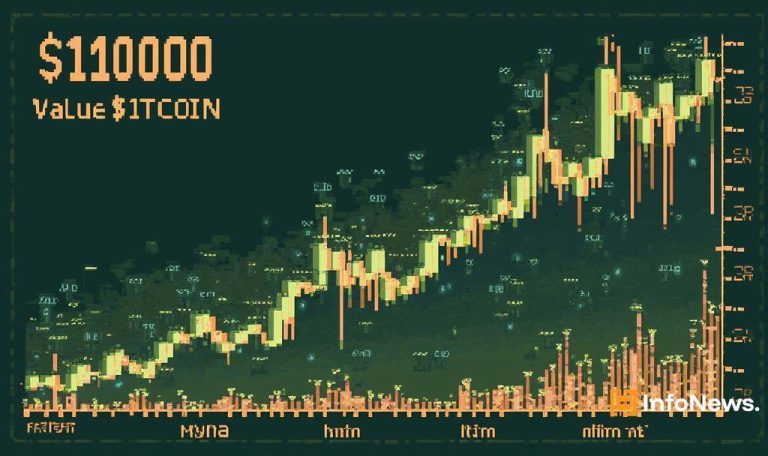

Standard Chartered has issued a warning on June 5, 2025, about potential risks to corporate Bitcoin holdings that could lead to forced liquidations due to price drops.

The warning comes amidst concerns that a 22% drop in Bitcoin prices could trigger extensive liquidations, possibly impacting the broader market negatively.

Bitcoin Price Drop Below $90,000 Triggers Alarm

Standard Chartered’s analysis identifies risks due to corporate Bitcoin treasuries. Held at prices above $90,000, these assets may force liquidation if Bitcoin prices fall significantly. Geoff Kendrick, a leading expert, warns of potential repercussions.

Geoff Kendrick from Standard Chartered highlighted the reverse pressure looming over Bitcoin. “We identify a pain level of 22% below the average purchase price as a potential liquidation level,” he notes, referencing the collapse of Core Scientific. With corporate holdings vastly impacted by price volatility, the potential market impact is significant if Bitcoin prices drop substantially.

Liquidity Worries Shake Corporate Bitcoin Strategy

Corporate Bitcoin holders face potential market repercussions. Standard Chartered’s warning could lead to cautious corporate strategies, affecting Bitcoin’s market dynamics if holders decide to retreat en masse due to price levels.

With large-scale Bitcoin liquidations possible, this poses implications for the financial market. The potential for mass unloading could adjust broader industry approaches and strategies towards asset management.

Core Scientific Collapse: A Cautionary Tale

The 2022 Core Scientific collapse provides a reference point, as it experienced significant losses due to Bitcoin price falls. A repeat could signal substantial disruption in the market structure and investor confidence.

Past trends indicate that such large-scale sell-offs could lead to heightened market stress, amplifying volatility. Analysts propose monitoring market movements closely to assess if corporate holdings might impact prices significantly.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |