Tether Aims to Become Largest Bitcoin Miner by 2025

- Tether aims to become the largest Bitcoin miner by 2025.

- Tether targets 80,000 BTC holdings for strategic influence.

- Intended expansion impacts Bitcoin and stablecoin markets.

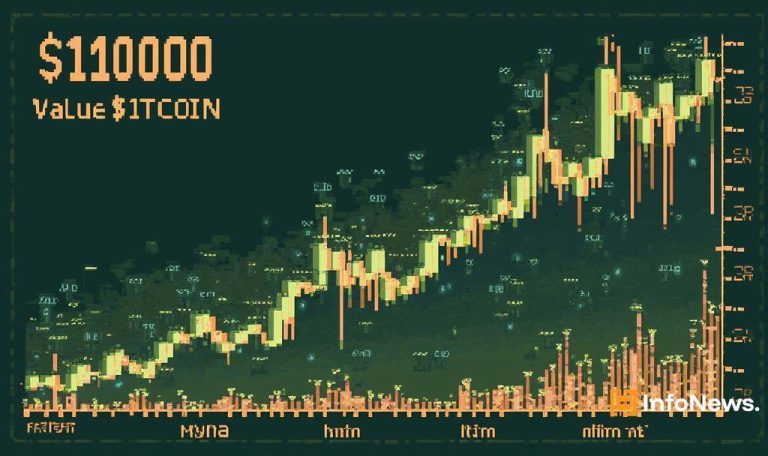

Tether CEO Paolo Ardoino announced plans to position the company as the largest Bitcoin miner by 2025, with ambitions to amass over 80,000 BTC.

This move, reflecting Tether’s strategic shift, could impact Bitcoin’s market, decentralization dynamics, and the operational role of stablecoins amid emerging on-chain trends.

Tether, led by CEO Paolo Ardoino, plans to establish itself as the largest Bitcoin miner by the end of 2025, amassing a total of 80,000 BTC.

This strategic move is significant for Tether’s role in the cryptocurrency market, potentially altering power dynamics and market stability.

Tether’s Ambitious Plan for Bitcoin Mining Dominance

Tether’s CEO Paolo Ardoino announced plans to become the largest Bitcoin miner by 2025, aiming to hold over 80,000 BTC. Ardoino’s statements emphasize this as a core company objective.

Tether has invested in more than 15 global mining sites, with Ardoino positioning these efforts alongside Tether’s USDT expansion. The firm wishes to mitigate risks from ecosystem manipulation.

Potential Impact on Bitcoin and Market Liquidity

This move is likely to affect Bitcoin’s price and network dynamics. Tether’s increasing BTC holdings may influence market liquidity and decentralization.

Financial markets may witness heightened activity in USDT, with on-chain data suggesting substantial impacts. Regulatory changes and infrastructure shifts may occur as a result.

Historical Comparisons with MicroStrategy’s BTC Strategy

Historically, major accumulations of BTC, like that by MicroStrategy, have altered market dynamics and liquidity. Tether’s scale and dual approach are unprecedented in history.

If successful, Tether’s strategy could reshape cryptocurrency landscapes, showing the potential impact of combining stablecoin issuance and Bitcoin mining. Past trends suggest significant economic implications.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |