Tether Executives Acquire Northern Data’s Bitcoin Mining Arm

- Sale involves Tether’s top executives.

- Emphasizes Tether’s investment strategy.

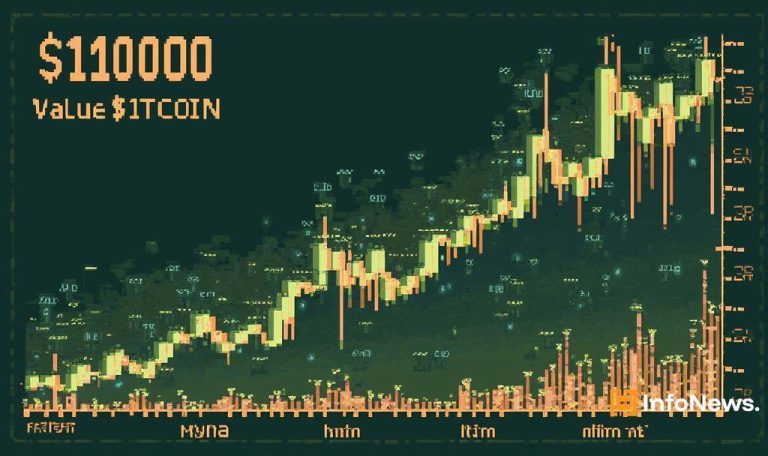

- Could influence bitcoin market dynamics.

Tether-backed Northern Data sold its bitcoin mining unit, Peak Mining, for up to $200 million to entities controlled by Tether executives Giancarlo Devasini and Paolo Ardoino, according to filings.

The sale reflects Tether’s strategic maneuvering within its business operations, shifting focus from mining to AI and datacenters, underlining concentrated ownership among key executives.

Northern Data sold its bitcoin mining unit, Peak Mining, for $200 million to companies led by Tether’s top executives, Giancarlo Devasini and Paolo Ardoino.

The transaction emphasizes Tether’s investment strategy and could influence market dynamics by consolidating mining resources under Tether’s control.

Northern Data Shifts Focus in $200M Sale

Northern Data, supported by Tether, agreed to sell its bitcoin mining arm for up to $200 million, focusing instead on AI and datacenters. The sale underscores strategic priorities.

We have agreed to sell our bitcoin mining unit Peak Mining for ‘up to $200 million’ as part of a strategic move to focus on AI and datacenters. — Northern Data AG, Corporate Leadership (source)

Tether’s executives, Giancarlo Devasini and Paolo Ardoino, control the acquiring entities. The transaction involves Highland Group Mining Inc., 2750418 Alberta ULC, and Appalachian Energy LLC.

Tether Expands Mining Operations Amidst Market Impact

The sale transfers substantial mining capacity to Tether-linked entities, potentially influencing bitcoin market dynamics. This move aligns with ongoing efforts to centralize mining operations.

The acquisition may impact the broader ecosystem, heightening investor focus on control and ownership dynamics in the cryptocurrency sector. Further analysis is awaited.

Failed $235M Sale Leads to Tether’s Strategic Acquisition

Similar to prior Tether strategies, the acquisition suggests a pattern of infrastructure consolidation. The move follows a failed earlier $235 million sale to a related entity.

This trend of internal asset shifts could solidify Tether’s market position. Experts anticipate potential jurisdictional scrutiny given ongoing European investigations into Northern Data.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |